WikiFX作为一家独立的第三方信息服务平台,致力于为用户提供全面、客观的交易商监管信息查询服务。WikiFX不直接参与任何外汇交易行为,也不提供任何形式的交易渠道推荐或投资建议。WikiFX对交易商的评分评级依据公开渠道的客观信息,并充分兼顾不同国家和地区的监管政策差异。交易商评分评级是WikiFX的核心产品,我们坚决反对任何可能损害其客观性和公正性的商业行为,欢迎全球用户的监督和建议。举报热线:report@wikifx.com

您当前语言与浏览器默认语言不一致,是否切换?

切换

- 关注

- 商业

- 动态

提供3年稳定ea服务7

关注

招聘个人 智能预警信号ea 全球对冲敢于创新ea

GMi官方直招8720

关注

GMI 的标准账户提供超低点差和高达 1:1000 的最高杠杆, 0 佣金 99.999 % 平台稳定运行 超低成本的交易解决方案 经验丰富的交易者们可以在真实市场条件下交易 GMI 的任何交易产品GMI 的标准账户提供超低点差和高达 1:1000 的最高杠杆, 0 佣金 99.999 % 平台稳定运行 超低成本的交易解决方案 经验丰富的交易者们可以在真实市场条件下交易 GMI 的任何交易产品GMI 的标准账户提供超低点差和高达 1:1000 的最高杠杆, 0 佣金 99.999 % 平台稳定运行 超低成本的交易解决方案 经验丰富的交易者们可以在真实市场条件下交易 GMI 的任何交易产品

DBG盾博平台高返23+

关注

在提供全球开放式社区,共享交易智慧的支持下,盾博DBG股指点差低至0.1,杠杆高达2000倍在提供全球开放式社区,共享交易智慧的支持下,盾博DBG股指点差低至0.1,杠杆高达2000倍在提供全球开放式

GMi官方直招8720

关注

在许多情况下,点差为0,在机构交易行业中也称为选择定价 GMI 是一家受正规监管且屡获殊荣的全球外汇交易商 我们最受欢迎的交易工具 更有专家市场分析,教育资源等助力您的交易在许多情况下,点差为0,在机构交易行业中也称为选择定价 GMI 是一家受正规监管且屡获殊荣的全球外汇交易商 我们最受欢迎的交易工具 更有专家市场分析,教育资源等助力您的交易在许多情况下,点差为0,在机构交易行业中也称为选择定价 GMI 是一家受正规监管且屡获殊荣的全球外汇交易商 我们最受欢迎的交易工具 更有专家市场分析,教育资源等助力您的交易

GMi官方直招8720

关注

MT Pro(或电子通信网络)账户 我们为全球超过 100 万交易者提供服务 包括初学者、经验丰富的交易员和资金经理 经验丰富的交易者们可以在真实市场条件下交易 GMI 的任何交易产品MT Pro(或电子通信网络)账户 我们为全球超过 100 万交易者提供服务 包括初学者、经验丰富的交易员和资金经理 经验丰富的交易者们可以在真实市场条件下交易 GMI 的任何交易产品MT Pro(或电子通信网络)账户 我们为全球超过 100 万交易者提供服务 包括初学者、经验丰富的交易员和资金经理 经验丰富的交易者们可以在真实市场条件下交易 GMI 的任何交易产品

亏货,来我们这啊,告别不确定因素

关注

招聘个人 一手套利ea 独家提供 跨平台

KCMTradeV:llmgyw0321

关注

KCM Trade 平台券商招商

【KCM Trade全球动态】一月全球活动回顾

官网+ TMGM588

关注

Tmgm可以申请主代理开无限极分代理,Tmgm是你实现外汇交易的首选平台,黄金20全返,欧元10全返,最大让利给下级代理。

Ecmarkets总部yunjianfx

关注

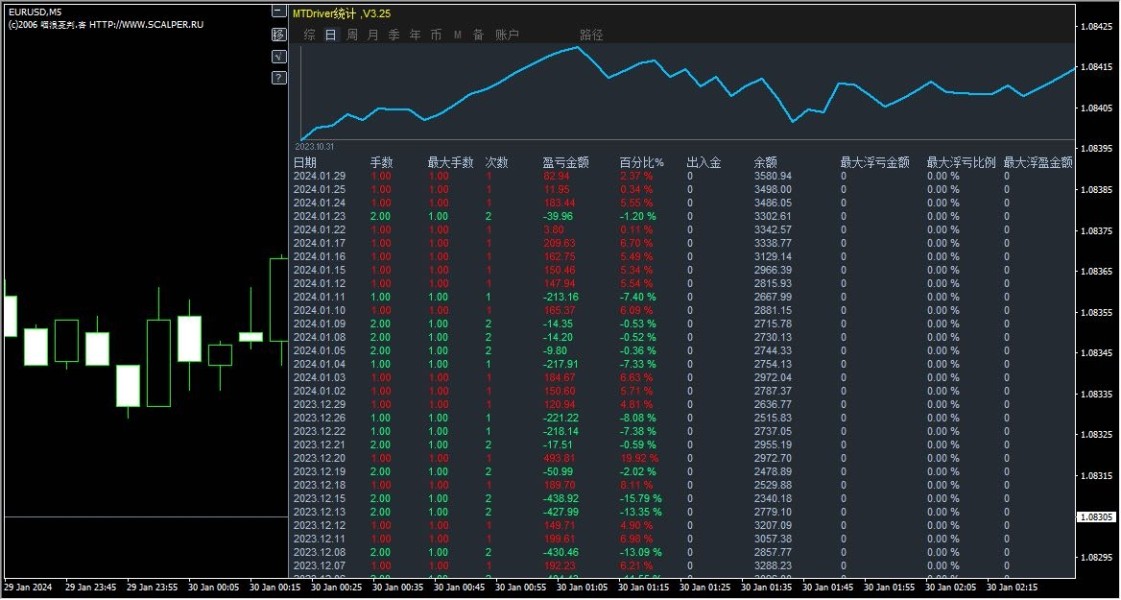

实盘推荐全球对冲敢于创新EA ,自动资金管理 ,多年交易团队,充分发挥多空盈亏相抵优势,很多客户都获得一致性好评。

DBG盾博平台高返23+

关注

在快速执行订单,效率卓越的支持下,盾博DBG最高20,000欧元的金融委员会补偿金在快速执行订单,效率卓越的支持下,盾博DBG最高20,000欧元的金融委员会补偿金在快速执行订单,效率卓越的支持下,盾

点击加载更多

登录/注册

发布商业服务

发布个人动态

可能感兴趣的人

换一换

TMGM招商高返+v TMGM2018

关注

总部直聘

HTFX·员工

关注

Lợi Nhuận Cao

关注

VT招代理、高返佣、EA信号源跟单-小风经理

VT Markets·员工

关注

gtc泽汇

关注

版权声明

我们郑重声明,平台上发布的所有信息内容,其版权均归属于合法的内容提供者或已被授权的WikiFX平台。我们严格遵守版权法律法规,确保所有信息的合法性与合规性。